Is The Rule of 78’s Theft, a Trick, or a Trap?

Well, that’s what some financial people would have you believe, anyway. (BankRate.com gleefully titled a column by Lucy Lazarony – “Watch Out For This Auto Loan TRICK.”)

The Motley Fool also calls it a “trick” in a column by Kailey Hagan:

“Hint: It’s another trick lenders use to line their pockets at your expense.” –https://www.fool.com/the-ascent/personal-loans/articles/what-is-a-precomputed-loan/

Does Hagan really think that the banks are NOT earning money off of Simple Interest? Surely she can’t think we are that stupid. Has no bank EVER lined it’s pockets by collecting Simple Interest?

Debt.org has a column called “The Rule of 78 – How To Avoid a Debt Trap.”

Short answer is, NO, it is not. A brief explainer:

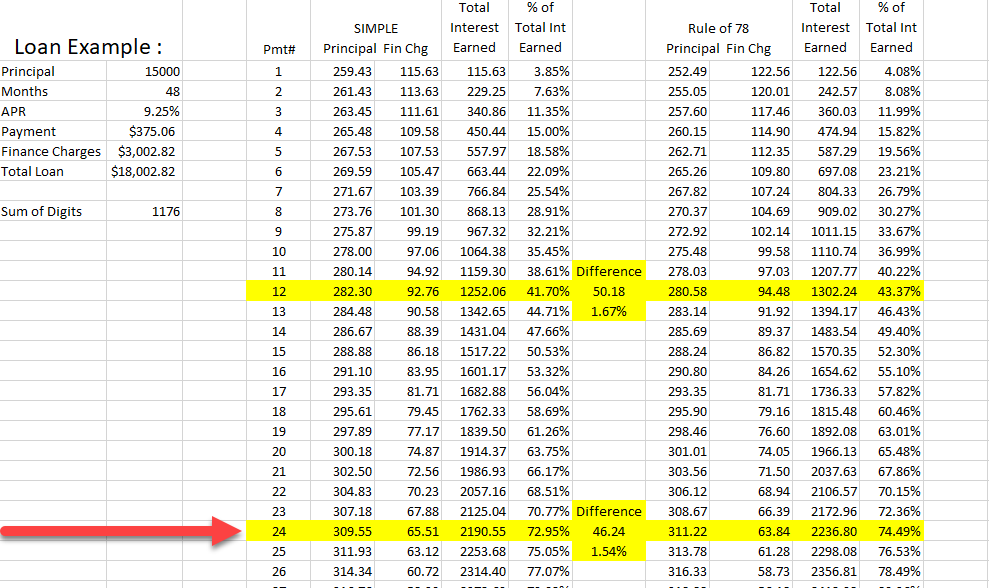

Example Loan: 15000 Financed for 48 Months @ 9.25 % APR. Payment=375.06/month, Total Finance Charges= 3002.88

Rule of 78’s uses a formula to allocate the Finance Charges (Aka Interest) on each payment that does not use the number of days, it uses the payment number. Also called “Pre-Computed,” because the Finance Charges are pre-computed for each payment. The formula uses the inverse payment number over the “Sum of the Digits” as a fraction multiplied by the Total Finance Charges to arrive at the Finance Charges due for this payment.

Using the above Loan Example, 48 Months:

The “Sum of the Digits” has a value of (1+2+3+4….+48) = 1176.

If you are on the 1st month, then the fraction is: 48/1176 = .040816

3002.88 x .040816 = 122.56 Finance Charges due for first payment.

(See Amortization Comparison below.)

By contrast, Simple Interest uses a formula that takes the APR/Days in Year to arrive at the Daily Rate. This rate is multiplied by the current Principal Balance to arrive at the Daily Finance Charges. That value is then multiplied by the number of days since the last payment or Loan Date to get the Accrued Finance Charges. Another version uses APR/Periods to arrive at a Periodic Rate. So, instead of APR/360 x Principal x 30 days, you’d simply have APR/12 x Principal to get one Month of Finance Charges.

Again using the Loan Example:

APR/Days in Year: 0925/360=.0002569444 = Daily Rate

.0002569444 x Principal 15000 = 3.854166 Daily Finance Charges.

Then, 3.854166 Daily x 30 days = 115.62 Accrued Finance Charges for the first payment.

— Noted, some Financial Institutions use 365 Days instead of 360.

Also note that this is the Standard Amortization. When the payment is paid, the Lender will typically use the Actual Days, So it will matter if the First Month has 30, 31, 28 or 29 Days to use for the formula for the Accrued Interest.

If the debtor pays his loan as agreed, on the due date, then the Simple Interest or Rule of 78’s loans will pay the same amount of Finance Charges.

The irresponsible and unprofessional scare tactic being used on some web pages is that with Pre-computed loans, the debtor owes ALL the future interest on Day one of the loan, and that the Lender sneakily does the Debtor a “favor” by allowing them a “Refund” on the unearned interest. Note the implication of a full payout and scare quotes in the below quote:

Let’s set this straight: Number One, the Debtor is LEGALLY entitled to only paying the Earned Interest. Calculating this, and removing the UN-earned Finance Charges, is NOT a “favor” to the consumer, the Lender is following the LAW. What some of these so-called “Financial Experts” call a “Refund” is actually a Rebate, that is, Unearned Finance Charges are calculated and removed from the balance before a Payoff is paid. Calling it a Refund makes the user believe that they have to pay it all, and hope that the Lender is gracious enough to give them some BACK. Websites like LendingPoint.com make people believe they have to pay off the gross balance.

Anyone claiming that this “refund” is an Optional or Voluntary to the Lender are either being intentionally dishonest or are proving they do not understand Financials as well as they claim. Ditto for the claim that Rule of 78’s is an intentional “trap.” People who make such claims are actually hurting the entire industry. Interesting that Debt.org, who calls it a “trap,” sheepishly admits in it’s column, that the prepayment “penalty is really not that severe.”

BankRate.com, on the “glossary” page for Rule of 78, uses the scare tactic that a precomputed loan pays “75 percent of the interest in the first 24 months of the (48 month) loan:

FIRST! Bankrate.com holds itself out to be a resource and glossary of banking terms and concepts. You would think that such a gathering of information or experts would know that “spreading the interest out evenly over the loan term” would require collecting the Finance Charges on the Straight-Line Method, which is illegal in most cases.

But, moving on: Let us compare Bankrate.com’s Horror Story Loan to Simple Interest: Their data supposes a 9.25% APR to arrive at a 48 month loan on $15,000.

The image below is a comparison of Pre-computed vs Simple Interest payments over the first 24 months of the loan. At 12 months, the difference in Total Interest earned is just $50.18, a mere 1.67% of the original $3002.82.

At Bankrate.com’s 24th Payment marker, the difference in Finance Charges collected is just $46.24, a pittance of 1.54% of the total collected.

The Simple Interest Loan actually collects 72.95% of the interest at this point compared to the Rule of 78’s collection of 74.49%. These are NOT “taking the deed to the widow Smith’s ranch” levels of bank evil.

These sites all swoon and clutch their pearls because “people who want to pay early or ahead won’t save any money.”

Gather round me, children, and listen well, there is a secret I will tell:

People who actually pay early and stay ahead have a credit score that in all but a few unusual circumstances, allows them to choose a loan or offer of credit that suits their needs.

Pre-computed or Rule of 78’s loans are typically offered to Sub-Prime, if not Deep Sub-Prime, clients who do not seem to have an issue paying early. Quite the opposite, in fact, these people tend to pay late, and in many cases, very late, and Rule of 78’s is actually the better loan for them!

Yes, I said it’s the Better Loan! Let’s explore why before you sharpen the pitchforks. Because the finance charges on a payment DO NOT CHANGE based on the date you pay it, (hence the word Pre-computed) there is no penalty for paying a few days (or weeks) late, except for Late Fees or Delinquency Charges, which either account type would pay.

If you are 12 days late with your first payment on the above loan with Simple Interest, you will pay additional interest for those 12 days. That amount is easily calculated at:

$15,000 x (9.25%/360) x 12 = $46.25 — And that is OVER and ABOVE the other interest charged. (Ignoring Late Fees for the moment)

Now, you can pay this extra, making your payment 421.31, or, you could pay just the 375.06 payment, and let it ride. HOWEVER, if you do this, then the Principal portion of that payment goes from 259.43 down to 213.18. This means the Principal Balance for calculating Payment #2 is higher than the original amortization, and therefore the interest on that payment rises, making the principal portion lower, and that makes Payment #3 have more interest. That 46.25 will cost you 66.35 over the life of the loan, even if you pay every other payment from 2 to 48 on time. That one late payment on #1 also makes the % of total finance charges earned at Payment #24 now higher on the Simple Interest Loan.

As we saw above, 15,000 at 9.25% is $3.85 additional interest per day in the first month. I have been in or advised this industry for over 30 years, and I have yet to see a Sub-prime or deep-sub-prime lender offer a loan below 18%. Most of what I see is 28% or more.

$15,000 at 28% APR is 11.67 PER DAY. 12 days costs you 140.04 on the first payment, and letting that ride will cost you $414.05 over the life of the loan.

At 28%, the Rule of 78’s guy can be few days late here or there, and not incur any additional interest. Would we rather a person who already has credit issues be able to pay off a car, or owe one or more payments at the end of the loan?

If you want to whine about what people pay for interest, tell your legislator to fix the maximum allowable rates, not how it’s collected, especially when it’s proven that the two methods are almost within a rounding error of each other.

Thanks as always for the read, see you next time.

1 comment